Rtgs Neft Form Of Union Bank Of India Download

The acronym 'RTGS' stands for Real Time Gross Settlement, which can be defined as. National Electronic Funds Transfer (NEFT) is a nation-wide system that. Of choice of deposits through as many as 10 different schemes offered by UBI.

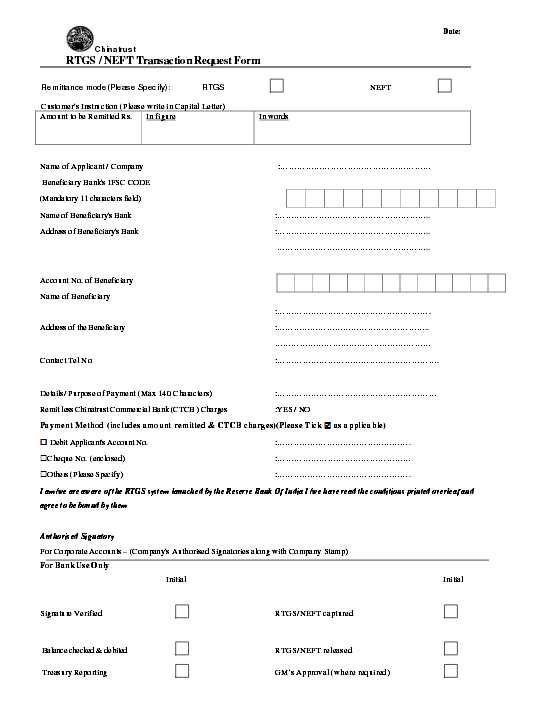

Contents • • • • • • • • Union Bank of India RTGS & NEFT Form Download Union Bank of India RTGS and NEFT Application Form in PDF Format. Download Union Bank of India NEFT Form in PDF Format, Download Union Bank of India RTGS Form in PDF Format, Download Latest & Updated Union Bank of India RTGS / NEFT Form in PDF format, Request form of RTGS/ NEFT for Union Bank of India, Download Union Bank of India Electronic Remittance Transaction Initiation Voucher (RTGS / NEFT), Download Union Bank of India NEFT Pay Slip, Download Union Bank of India RTGS Pay Slip in PDF,Union Bank of India IMPS Transfer Form,. Just input the details of name of Branch, Amount to be remitted and details of Remitter and beneficiary. Now scroll down below and Download Union Bank of India RTGS, NEFT Form in PDF Format. Union Bank of India RTGS Form /DD Form: in English Also Refer Union Bank of India NEFT Form: Features of Union Bank of India RTGS. Real Time Gross Settlement [RTGS], introduced by us as Union Bullet, is the fastest possible mode of money transfer through bank channels available in India.

It’s a fund transfer mechanism where transfer of money takes place from one bank to another in real time and on ‘gross basis’. Presently, there are over 50000 bank branches enabled for remitting and receiving funds through RTGS. RTGS is primarily for large value remittances. The minimum amount to be remitted through RTGS is Rs.2.00 Lakh. SALIENT FEATURES Customers can remit any amount using RTGS. Customers intending to remit money through RTGS have to furnish the following particulars: • IFSC (Indian Financial System Code) of the beneficiary Bank/Branch. • Full account number of the beneficiary.

• Name of the beneficiary. The facility is also available through online mode for all internet banking customers.

For corporate customers, bulk upload facility is also available at branches. TIMINGS Monday to Friday:8.00Hrs to 16.20Hrs. Bulk RTGS File should be uploaded before 15:50Hrs for same day processing.

Saturday(except 2nd & 4th Saturdays):8.00Hrs to 16.20Hrs. Bulk RTGS File should be uploaded before 15:50Hrs. Sunday is holiday. Under this facility money will be credited to the beneficiary account instantly on ‘real time’ basis.

Union Bank offers RTGS facility to its customers through all its branches. Union Bank offers RTGS facility to its customers through all its branches. CHARGES For transaction amount from Rs. 2 Lac & up to Rs. 5 Lacs: Rs.25.00 + taxes (From 08:00 Hrs & up to 11:00 Hrs) Rs.27.00 + taxes (After 11:00 Hrs & up to 13:00 Hrs) Rs.30.00 + taxes (After 13:00 Hrs) For transaction amount more than Rs. 5 Lacs: Rs.50.00 + taxes (From 08:00 Hrs & up to 11:00 Hrs) Rs.52.00 + taxes (After 11:00 Hrs & up to 13:00 Hrs) Rs.55.00 + taxes (After 13:00 Hrs) NOTE: Charges are waived for customers availing services at branches in North Eastern States Features of Union Bank of India NEFT.

National Electronic Funds Transfer (NEFT) NEFT is electronic funds transfer system, which facilitates transfer of funds to other bank accounts across the country. This is a simple, secure, safe, fastest and cost effective way to transfer funds especially for Retail remittances. FEATURES & BENEFITS Customers can remit any amount using NEFT Customer intending to remit money through NEFT has to furnish the following particulars: • IFSC (Indian Financial System Code) of the beneficiary Bank/Branch • Full account number of the beneficiary. • Name of the beneficiary. The facility is also available through online mode for all internet banking and mobile banking customers. For corporate customers, bulk upload facility is also available at branches. TIMINGS Customers can use this facility between 8 AM and 06.30 PM on all weekdays and between 8 AM and 06:30 PM on Saturday (except 2nd & 4th Saturdays).There are twelve hourly settlements between 8 AM and 7 PM on all weekdays and between 8 AM and 7 PM on Saturday (except 2nd & 4th Saturdays).